W 4 Single Example

- W 4 Single Example Binary

- W-4 Single 0 Example

- W 4 Single Example Two

- W-4 Single Woman Example

- W 4 Single Example Worksheet

- W 4 Single Example Letter

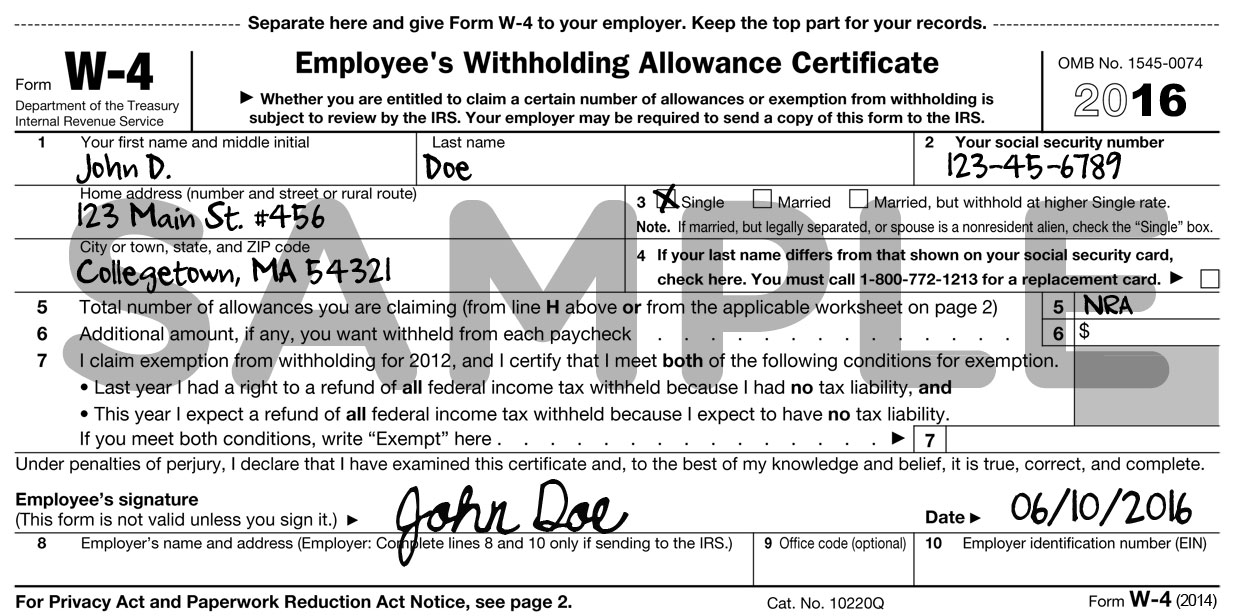

If you’re filling out a Form W-4, you probably just started a new job. Or maybe you recently got married or had a baby. The W-4, also called the Employee’s Withholding Certificate, tells your employer how much federal income tax to withhold from your paycheck. The form was redesigned for 2020, which is why it looks different if you’ve filled one out before then. The biggest change is that it no longer talks about “allowances,” which many people found confusing. Instead, if you want an additional amount withheld (perhaps your spouse earns considerably more than you), you simply state the amount per pay period. Here, we answer frequently asked questions about the W-4, including how to fill it out, what’s changed and how the W-4 is different from the W-2.

How to Fill Out a W-9 for a Single Member Limited Liability Company. When you own a limited liability company (LLC) and enter into a contract with an individual or company to perform services, the person paying you is required to obtain a W-9 form. What is the purpose of the redesign? The purpose of the updated form is to better match the. Jan 04, 2021 Either way, you should do what's right for you and filling out the Form W-4 properly is the first step. Now let's get into the mechanics of how to fill out a Form W-4. Filling Out a Form W-4. Though it's hard to see when looking at the form, the basic process of completing a W-4 is actually pretty simple. If an employer does not receive a completed Form W-4 from an employee, they are authorized to withhold federal income tax at the Single – No Deductions rate. Filling a W-4 out incorrectly can mean employees have unexpected tax liabilities at the end of the year, so encourage them to take their time and follow the instructions carefully. Both examples are focusing on new 2020 W-4 forms. So here is our first example, first example is for anyone using an Automated Payroll System. Sophie is a new employee, she submitted a 2020 Form W-4 to her employer when she was hired. Is Step 1 of her Form W-4, she selected Married Filing Jointly as her filing status and she also checked the.

Go beyond taxes to build a comprehensive financial plan. Find a local financial advisor today.

Why Do I Need to Fill Out Form W-4?

As just noted, the form tells your employer how much federal income tax to withhold from your paycheck. You’ll need to complete a new W-4 every time you start a new job. If your new company forgets to give you one for some reason, be sure to ask. If your employer doesn’t have a W-4 form from you, the IRS requires it to treat you as a single tax filer, which means withholding the highest possible amount from your paycheck for taxes. You can get back the amount you overpay, but only in the new year when you file your tax return.

Do I Need to Submit the New Form W-4?

You should complete the redesigned W-4 only if you started a new job – or if your filing status or financial situation has changed. You do not need to fill out the new form if you have not changed employers. Your company can still use the information provided on the old W-4 form.

How Long Does It Take for W-4 Changes to Be Implemented?

When you submit a W-4, you can expect the information to go into effect fairly quickly. But how long exactly before your paycheck reflects the changes largely depends on your payroll system. Ask your employer when you turn in the form.

How Is the New W-4 Different from the Old W-4?

The biggest change is the removal of the allowances section. You no longer need to calculate how many allowances to claim to increase or decrease your withholding. The new form instead asks you to indicate whether you have more than one job or if your spouse works; how many dependents you have, and if you have other income (not from jobs), deductions or extra withholding. The new form also provides more privacy in the sense that if you do not want your employer to know you have more than one job, you do not turn in the multiple job worksheet.

How to Fill Out the W-4?

As far as IRS forms go, the new W-4 form is pretty straightforward. It has only five steps. If you are single, have one job, have no children, have no other income and plan on claiming the standard deduction on your tax return, you only need to fill out Step 1 (your name, address, Social Security number and filing status) and Step 5 (your signature).

W 4 Single Example Binary

If you have more than one job or your spouse works, you’ll need to fill out Step 2. If you have children, Step 3 applies to you. And if you have other income (not from jobs), you’ll be itemizing your deductions on your tax return or you want an extra amount withheld (including from other jobs), you can indicate your adjustments in Step 4.

How to Fill Out Step 2: Multiple Jobs or Spouse Works?

If your spouse works and you file jointly or if you have a second or third job, you can use either the IRS app or the two-earners/multiple jobs worksheet (page three of the W-4 instructions) to calculate how much extra should be withheld (you put this amount in Step 4). If there are only two jobs (i.e., you and your spouse each have a job, or you have two), you just check the box. (Your spouse should do the same on his or her form or you check the box on the W-4 for the other job, too.)

How to Fill Out Step 3: Claim Dependents?

You fill this out if you earn $200,000 or less (or $400,000 or less for joint filers) and have dependents. It’s a simple calculation where you multiply the number of children under age 17 by $2,000 and the number of other dependents by $500 – and add the two sums.

How to Fill Out Step 4a: Other Income (Not from Jobs)?

W-4 Single 0 Example

If you have interest, dividends or capital gains that you’ll owe taxes on, you can indicate here the total amount of non-pay income here. Your employer will figure it into how much taxes to withhold from your paycheck.

How to Fill Out Step 4b: Deductions?

The deductions worksheet requires some math. You’ll also need to know how much you claimed in deductions on your last tax return. If you claimed the standard deduction, you don’t need to fill this out. If you claimed more than the standard amount, this worksheet will help you calculate how much more. Once you have this amount, you add any student loan interest, deductible IRA contributions and certain other adjustments. You then put this total on the form.

If you get stuck, use the IRS’s withholding app.

How to Fill Out Step 4c: Extra Withholding?

If you will owe more in taxes than what your salary alone would indicate, you can say here how much more you want withheld per pay period. If the extra amount is because your spouse works or because you have more than one job, you enter the amount you calculated in Step 2 – plus any other amount you want withheld.

How Does the W-4 Form Differ From the W-2?

Yes, both of these forms start with the letter ‘w,’ but that’s where the similarities end.

Unlike a W-4, a W-2 form is what your employer fills out for all employees and files with the IRS. It shows your annual earnings from wages and tips. It also states the amounts withheld for the year for Social Security, Medicare, state, local and federal income taxes.

The Bottom Line

If you aren’t switching jobs or going through life changes, you don’t need to refile your W-4 just because the form has changed. However, all new employees need to fill out a W-4 to avoid overpaying taxes. While the form is more straightforward and doesn’t include allowances like it did in the past, it’s still important to properly and accurately list information on your W-4.

Tax Planning and Your Financial Plan

- Income taxes are just one aspect of tax planning. If you want to preserve what you’ve earned and grow it in the most tax-efficient way, a financial advisor can help. To find a financial advisor to work with, use SmartAsset’s free tool. It connects you with up to three advisors in your area. If you’re ready to be matched with local advisors, get started now.

- Starting a new job? Even before you fill out your W-4, you can get an estimate for how much your take-home pay will be. Just use our paycheck calculator.

Photo credit: IRS.gov ©iStock.com/PeopleImages, ©iStock.com/wdstock

We think it's important for you to understand how we make money. It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

This article was fact-checked by our editors and Christina Taylor, MBA, senior manager of tax operations for Credit Karma Tax®. It has been updated for the 2020 tax year.

If you work for someone other than yourself, chances are good you’ve filled out a W-4 with your new-hire paperwork.

A W-4 tells your employer how much money to withhold from your paycheck to put toward your federal income tax liability. If you withhold too little, you could end up owing taxes (and possibly a penalty) when you file your federal income tax return. If you withhold more than you need to, you could end up with a refund (which might not sound too bad).

Do you prefer to have more take-home pay throughout the year? Would you rather get a refund? Or do you want to pay exactly the right amount of tax? Whatever your financial objective, you’ll need to understand how to fill out a W-4 to help you achieve it.

What is a W-4?

A Form W-4, Employee’s Withholding Certificate (formerly known as Employee’s Withholding Allowance Certificate) is an IRS form that tells your employer how much federal income tax to withhold from your paycheck. You complete the form and provide it to your employer, who may have to share it with the IRS.

The amount your employer withholds will also depend on how much you earn each pay period and how you’re paid (weekly, twice-monthly, etc.), as well as the information you put on your W-4.

What information is on a W-4?

If you fill out a W-4 after Jan. 1, 2020, you’ll be working with a revised form that eliminates the concept of withholding allowances, which confused many people. Now, you won’t have to try to decide how many allowances to take or whether to choose zero allowances — the revised form aims to be more straightforward.

/how-to-fill-out-form-w-4-0947bf269e304790a4a4e818b097522f.png)

The new Form W-4 includes …

- Your basic personal information, such as your name, address, Social Security number and filing status — single, married filing separately, married filing jointly, qualifying widower or head of household.

- A worksheet for people with income from multiple jobs. This would apply if you hold more than one job yourself or you’re filing jointly with a spouse who also has a job, for example.

- Information to help determine whether you have dependents and meet income requirements for claiming the child tax credit and credit for other dependents.

- Other income, deductions and extra withholding amounts that may affect the amount you have withheld from your paycheck.

How do I fill out a W-4?

W 4 Single Example Two

The new W-4 is separated into five steps.

Step 1: Enter your personal information

In this section you’ll enter your name, address, filing status and Social Security number.

Be sure the name you provide matches the one on your Social Security card. If it doesn’t, you might not get credit for your withholdings. If you need to update your name on your Social Security file, you can call the Social Security Administration at 1-800-772-1213 or go to ssa.gov.

If you’re not required to have federal income tax withheld from your paycheck, you can skip ahead to Step 5 (where you sign the W-4 form). You may be exempt from withholding if you didn’t owe any federal tax in the previous tax year and don’t expect to owe any for the current tax year.

W-4 Single Woman Example

Step 2: Complete if you have multiple jobs or two earners in your household

You have to do this section only if it applies to you. If you work a second job or file jointly with a spouse who also works, you’ll need to complete this step. You can do this by either using the IRS Tax Withholding Estimator (you’re required to use this option if you or your spouse have self-employment income) or by using the Multiple Jobs Worksheet included with the W-4 instructions.

If you’re dealing with two jobs that have similar pay, you can simply check the box on Line C of this section.

Step 3: Claim Dependents

If you filled out Step 2, you’ll complete Step 3 for only one of the jobs from Step 2. The IRS recommends you work with the highest-paying job to get the most accurate withholding.

Step 3 should help you determine if you qualify for the child tax credit and the credit for other dependents, and if so, how much you might qualify for. If you qualify for the credit, it can directly reduce the amount of tax you owe, and you may be able to withhold less tax from your paycheck.

Step 4: Other Adjustments

This section is optional and includes just three lines to fill in. If you have non-wage income that won’t be subject to withholding, like interest, dividends or retirement income, you can include it here to incorporate into your withholding adjustments.

If you think you’ll itemize your deductions instead of taking the standard deduction amount for your filing status, you can complete the worksheet on Page 3 of the form and record the result in this section.

And this is where you can tell your employer to withhold an additional amount of tax from your paycheck each pay period. You might do this if you want to increase your refund or reduce any amount of tax you may owe when it’s time to file.

Step 5: Sign your form

You’ll sign the form here to inform the IRS that you’ve completed your W-4 as thoroughly, accurately and honestly as you know how. This is also where your employer will fill in its name, address, employer identification number, and your start date.

FAST FACTS

What are the standard deduction amounts by filing status?

These are the standard deduction amounts for 2020 taxes (which you’ll file in 2021).

$12,400 for single filers and those married filing separately

$18,650 for head of household filers

$24,800 for those married filing jointly or qualifying widower

When should I fill out a W-4?

When you start a new job, your employer is required to have you complete a W-4. Your employer must keep your W-4 on file for at least four years. The IRS also recommends you consider completing a new W-4 if …

- You’ve gone through a major life change, like getting married or having a child.

- You had too much or too little tax withheld in the previous tax year and you want to get closer to your actual tax obligation for the current tax year.

- If you had a major financial change (for example, a significant raise or bonus at work).

You can complete a new W-4 at any time you experience one of these changes during the year since taxes are withheld throughout the year. But check with your company’s payroll department on how to do this so you follow any policies it has for updating a W-4.

One piece of good news: If you’ve already submitted a W-4 to your employer, haven’t changed jobs, or had a life change that would require you to submit a new W-4, and you’re happy with your tax withholdings each year, you don’t have to fill out a new W-4 just because the form has changed in 2020. You can if you want to, but it’s not required.

Where can I go for help?

If you want help figuring out your withholding amount, the IRS offers an online Tax Withholding Estimator. The withholding calculator can also give you an idea of whether you’ll owe or get a refund based on the amount you’re currently having withheld and the amount of tax you owe for the year.

The IRS says the tool should work for most taxpayers, but if your tax situation is more complex, you might want to check out Publication 505, Tax Withholding and Estimated Tax.

What about my state income tax withholding?

The W-4 is designed for your federal income tax withholding. If your state has a state-level income tax (not all do), it may have its own form you’ll have to fill out in order to have state tax withheld from your paycheck.

For example, in New York state, employees fill out Form IT-2104 to inform employers of their withholding amounts. In Alabama, employers can’t base withholdings on the W-4. Instead, they must have employees complete Form A-4, the state exemption certificate.

Some states use the federal W-4. For example, Colorado and South Carolina both use the federal W-4, though South Carolina says it may create its own form because of changes to the federal one.

If you’re not sure what form to use, or if you need one at all, check with your company’s human resources or your state’s department of revenue or other tax administration agency.

Learn where to file state taxes for freeW 4 Single Example Worksheet

Bottom line

Knowing how to fill out a W-4 can help you better manage your taxes throughout the year. The information on your W-4 will help determine how much you might owe, if you’ll get a refund and how big your refund could be. The IRS recommends using its Tax Withholding Estimator to do a “paycheck checkup.”

If you want to change your withholdings, you can update your W-4 at any time you experience a qualifying change. To make changes on your W-4, contact your employer. There may be an online portal you can use for W-4 changes, or you may have to submit a new paper form.

Relevant sources: IRS: Tax Withholding for Individuals IRS: About Form W-2, Wage and Tax Statement IRS: Topic No. 306 Penalty for Underpayment of Estimated Tax IRS: IRS Withholding Tables Frequently Asked Questions

Christina Taylor is senior manager of tax operations for Credit Karma Tax®. She has more than a dozen years of experience in tax, accounting and business operations. Christina founded her own accounting consultancy and managed it for more than six years. She co-developed an online DIY tax-preparation product, serving as chief operating officer for seven years. She is the current treasurer of the National Association of Computerized Tax Processors and holds a bachelor’s in business administration/accounting from Baker College and an MBA from Meredith College. You can find her on LinkedIn.